Market Notes (3:30pm ET): Tired of having the bears push them around, the bulls marched back into the ring and delivered a heavy blow to the bears. The expectation on the Street (at least according to the Wall Street Journal) is that the Fed will keep its accommodative stance for a "considerable period". No doubt this had something to do with today's bullish ebullience. While there's no reason for the Fed to do anything rash, there is still the possibility that it may do what the Street least expects. We shall find out which way the wind will be blowing soon enough.

Today's market action was pretty much a mirror image of yesterday's. Other than the banks and gaming stocks, pretty much the rest of the sectors are trading in the green. In commodities, the hard commodities (metals, oil) rebounded strongly while the dollar (which has been on a tear) lagged. On the global front, Brazilian stocks enjoyed big gains especially the banks (BBD, ITUB) and oil (PBR).

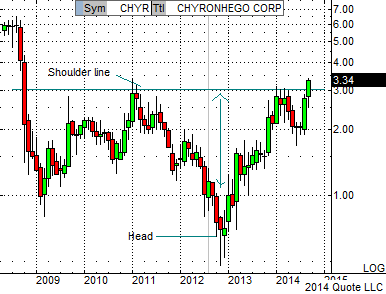

In individual stocks, retailer Kohl's (KSS, $61) broke out of five and a half year trading range on no news other than some favorable articles on the company's brightening prospects for the second half of the year. On the small-cap front, shares of broadcast graphics provider ChyronHego (CHYR, $3.33) rallied over 7% on more than four times normal volume. The move caused the stock to break out of a five year inverse head and shoulders pattern which is a very bullish technical event. (See the weekly chart of the stock above.) Based on the distance from the head to the shoulder line, the stock could easily move to the $5 - $5.50 range. In its last earnings report, the company blew out estimates on both the top and bottom lines.