Financially Strong - Technically Sound

C. H. Robinson - Opportunity after a Pullback

By Paul Price of Market Shadows

Market Shadows doesn’t try to time the market. We look to enter trades at prices that make sense.

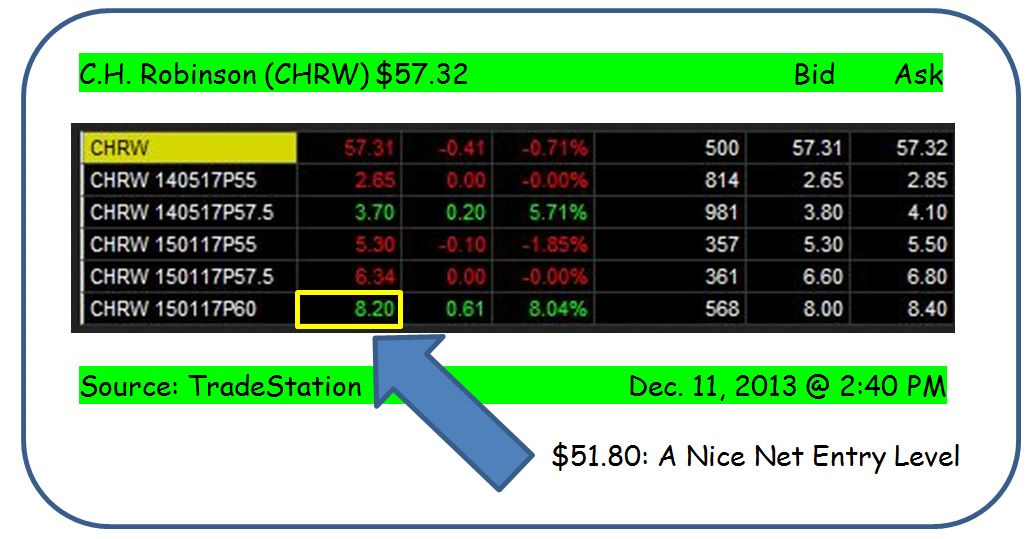

Logistics provider C. H. Robinson is a high-quality company having a rare slightly down earnings year. The stock has pulled back from a 2011 peak of $81 to just $57.32. It has rarely yielded as much as today’s 2.43%.

The shares have shown solid technical support at $51 - $52 since the start of 2010. The company is debt-free.

We sold one Jan. 2015 $60 put today for $8.20 per share. Our maximum profit would be to keep the $820 premium if the option expires worthless. The risk is to be forced to buy 100 shares at a net cost of $60 (the strike price) less $8.20 (the put premium) = $51.80 per share.

That’s a price we could live with and one that hasn’t persisted for long over the most recent four years.

The trade has been added to our Virtual Put Selling Portfolio .

None.